"Building a simple winning portfolio for every Stage of Life" - Defining the basics

- Pratap Chandra

- Jun 16, 2023

- 8 min read

Updated: Jun 23, 2023

Some of my friends asked me to specifically write a blog for investors who are in the age bracket of 35/45 and above. I thought why not i write a blog which reflects every age of an investors life cycle. so here it is.

I. Introduction

Let us get into how should we build a portfolio for long term returns. In general, i call long term as a period which is minimum of 10+ years. This portfolio building is dependent also on the age factor. If you are young in your 20's to 30's there is a certain risk tolerance criteria and if you are in your 40's and 50's then there can be a different criteria for building our portfolio. Long term investing strategies for financial independence should be simple , they need to cover the major asset classes (at-least 2-3) like stocks , bonds and gold in the core portfolio that can boos the returns in the long term. History has proven that if we stay consistent given the time horizon of more than 10+years with sound investment philosophy there is no chance of loosing the money in the market. Before we talk about risk tolerance and how it is defined, we will look into the basics of asset classes.

II. Defining different Asset classes:

In investing, an asset class is a group of financial instruments that have similar characteristics and behave similarly in the marketplace. These are often subject to the same laws and regulations. Here are some of the main asset classes:

1) Equities (Stocks): These represent ownership in a company. When you buy a stock, you become a shareholder in that company. Stocks have the potential for high returns but also come with high risk, as their value can fluctuate significantly.

2) Fixed Income (Bonds): These are essentially loans made by an investor to a borrower, typically corporate or governmental. Bonds are designed to pay back the principal amount with interest over a specific period of time. They tend to be less risky than stocks and provide regular income, making them popular among conservative investors.

3) Commodities: These include physical assets like gold, silver, oil, natural gas, agricultural products, etc. Commodity prices can be highly volatile and are influenced by factors such as supply and demand changes, geopolitical events, or changes in currency values.

4) Mutual Funds: These are investment vehicles that pool together money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets. They are managed by professional portfolio managers.

5) Exchange-Traded Funds (ETFs): These are similar to mutual funds but are traded on stock exchanges. ETFs can track a specific index, sector, commodity, or asset class. These can be bought by individual investors.

There are more asset classes, like crypto, hedge funds, derivatives, venture capital, private equity and other high risk tools which we will not focus on much, as the degree of risk involved in those asset classes is not tolerable for an ideal investor. In other words, the risk is way higher than we can imagine. Now, lets delve into the topic of risk tolerance since now we know what are asset classes.

III. Understanding Risk Tolerance and Time Horizon:

Our age influences risk tolerance and investment time horizon. Generally, younger investors have a longer time horizon and can afford to take more risks, while older investors nearing retirement may prefer less risky investments. Firstly, we need to identify our risk profile what is it? A risk profile is an evaluation of an individual’s willingness and ability to take risks. What most people don’t realise is that this can be done without much financial knowledge. No matter where you live in the world the composition of our investment portfolio shouldn't change significantly, because these days, everyone can access global markets from the touch of a button on a stock broking app.

A person usually in their 20's has high risk tolerance since he has a long investing horizon of at-least 40 years until his retirement. On the other hand a person in their 40's might have less risk tolerance since he only has 20 years to his retirement. In these scenario's it is always advisable to diversify our portfolios with different asset classes like Equity (stocks), treasuries (bonds) and gold.

So for a 20-30 year old bracket, we can consider a portfolio which has 70% stocks or equity , and 25% bonds and 5% gold. Remember, when i am talking about asset classes, the best way to invest in these is through ETF's (Exchange Traded Funds) which are available in various currencies like USD, EUR, GBP etc.

Similarly, for 40-50 year old bracket , we can consider a portfolio which has 50% stocks or equity, and 40% bonds and 10% gold.

The main reason for the reduction of equity in the older age group is primarily because of the volatility that one faces in the equity segment. However this is not a hard and fast rule which everyone has to implement in their portfolios. Its completely dependent on the person's risk tolerance levels. For example a person in his 40's can also have a high portfolio concentration of equities, based on his income levels and his risk taking ability. Remember the phrase "High risk, high reward?" its true most of the time, and definitely over a long term.

IV. Three most important fundamentals in investing over the long run

1) Right balance between stocks and bonds

2) Being consistent in keeping the approach that we choose (Diligent Investing)

3) Being Patient ( this is the single most important fundamental in investing. Patience pays)

V. Asset Allocation:

The most renowned Asset allocation model is followed by the Jack bogle fans is the famous 60/40 Portfolio, i.e; 60% stocks and 40% bonds. This is has returned an annual CAGR of 8% in the last 50 years. Similarly, we can go for a 70/30 portfolio for higher risk

How much money should I keep in Bonds?

This is different for different personalities, knowing yourself and your goals matters most – you should always align your Portfolio with your objectives and that’s why this Portfolio should be individual and tailored to your needs and not benchmarked against other people you know.

Take this questionnaire first to understand what Stocks/Bond allocation you need at this link, it is free from Vanguard.

VI. Global Market Capitalisation of Capital Markets ?

When it comes to buying equity, the best , safest, long term strategy is to buy an ETF like the S&P 500 ETF which we spoke about in my last blog, similarly we can buy a global bond ETF which tracks the treasuries of the entire developed market index or the world market index.

However I will explain how these equity ETF's are split in terms of market capitalisation of world stock markets.

CURRENT COUNTRY WEIGHTS IN THE WORLD EQUITY INDEX

Image 1- Source: bankeronwheels

As you can see, currently, 60% of all World Stocks as measured by market capitalisation are US Equities, but it wasn’t always that way.

It may not always be the case in the future. While there are reasons for the current allocations, imagine if China or India advanced their capital market liberalisation and transparency. China's current weight in the global stock market is only about 4%, despite the fact that its GDP is 65% that of the US. The balance of Emerging Market sectors, with more Tech, is also changing. And US Tech frequently lacks access to these markets.

VII. Lets Look at the terms "Developed and Emerging Markets"

Developed market is a country or market that is most developed in terms of its economy and capital markets. The country must be high income, but this also includes openness to foreign ownership, ease of capital movement, and efficiency of market institutions.

On the other hand An emerging market (or an emerging country or an emerging economy) is a market that has some characteristics of a developed market, but does not fully meet its standards.

Lets look at some maps on which countries are developed and which countries are emerging.

EMERGING MARKETS ( India, China, Russia, Brazil, South Africa, Egypt, Indonesia, Turkey etc)

Image 2 - Emerging markets - Source: Google

DEVELOPED MARKETS ( US, Europe, Australia, Japan, South Korea)

Image -3 Developed markets - Source: Google

VIII. So What should my Portfolio look like and what funds should i buy?

An ALL WORLD ETF IS THE MOST SIMPLE INVESTMENT

Q) Do You Need Knowledge To Invest?

A) You don't need a lot of knowledge to put your money to work. In fact, you only need one ETF to gain exposure to World Equities. And as specific markets grow or shrink, this exposure changes automatically.

So the ALL WORLD ETF consists of all global stocks (roughly 3800 stocks) based on the global market capitalisation map (as shown in Image 1 above).

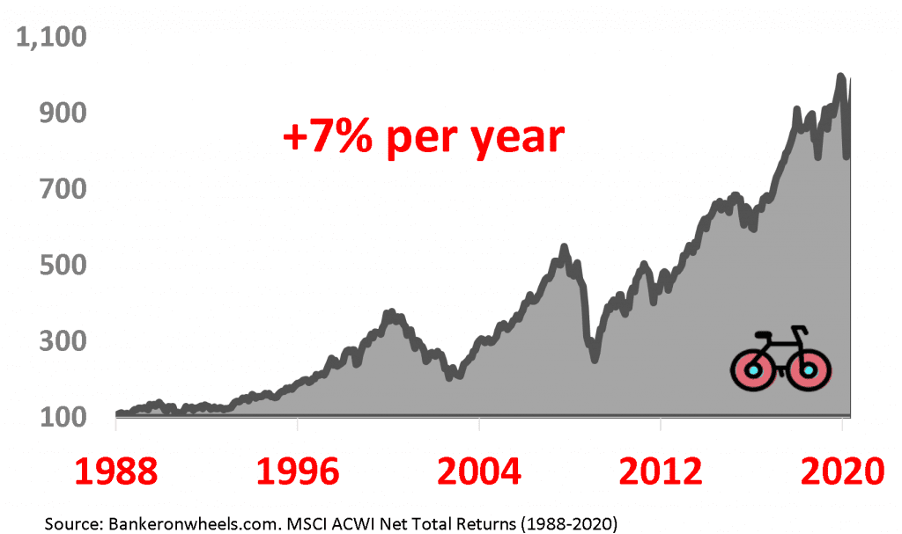

What is the performance of this World ETF in the last 10 years ? lets look at it

If you assume a 10-year investment horizon, $1,000 invested and held for the full term would have earned almost 7% per year (allowing for 0.3 percent fees but before 2-2.5 percent inflation), and your wealth would have more than doubled.

For a fact, given how compound interest works, if you held for more than a decade, the return would be closer to exponential over time.

IX. Main reasons to consider a global ETF:

1) The world ETF covers the entire global stock markets , countries and sectors

2) The world ETF is unbiased, means there is no human mind playing around with our money. Its automated index tracking

3) The world ETF is hassle free - just put money and forget it

4) The world ETF is cheap - If you have one ETF the cost is less and also you will have less transaction fees. less need to rebalance.

X. Which ETF's to go for an Why

As an expat from any country, the best ETF which follows the FTSE all world index is called as "VWRA - Vanguard FTSE all world ETF" it trades on the London stock exchange and trades in USD" . you can find more information about this ETF in file which i am sharing here below as a pdf.

so if you see VWRA as an ETF consists of 3691 stocks based on the market capitalisation i showed in the above image. so basically the investor who invest in this ETF is owning the entire global stock market :). Isnt it wonderful and simple? all you need to do now is to keep adding certain pre-defined amount per month, say 500$, or 1000$ and keep buying this ETF every month.

XI. What about Bonds?

Bond is a fixed income instrument that represents a loan made by an investor to a borrower. Bonds are a vital component of any balanced or well defined portfolio because they offer several benefits such as :

Higher returns than bank accounts over long term

Lower volatility and risk than stocks

Diversification to stock portfolios and protection against losses.

So as you can see a good balanced portfolio has 60% stocks and 40% bonds. If the risk appetite of the investor is high, then you can have 75% stocks and 25% bonds. Remember, in your investing career, you need to keep track of this balance as you move on in your journey.

So similar to VWRA for the global stock or equity ETF's you also have an option of a global bond ETF known as AGGU (iShares Core Gl Aggregate Bd UCITS ETF USD Hgd Acc) The ETF consists of all global bond indexes in one making it easier for the investor to diversify

In the next blog, we will look into how these ETF's track the indexes and what are the tax implications, why we need to invest in London stock exchange and not the US exchanges, and what is with-holding tax in the US and more.....so keep glued to my blogs ....see you soon.

Great insights. Would love to read more.